Msabaeka Manicaland’s pioneering businessman, philanthropist and liberation war collaborator laid to rest as a Provincial Liberation War Hero

April 26, 2024

Manicaland captains of industry and commerce call for consistent market led intervention polices in 2024 MPS

April 30, 202450% payment in ZiG of QPD will compel fuel suppliers to sell some fuel in ZiG: RBZ Governor

Reserve Bank of Zimbabwe (RBZ) governor Dr John Mushayavanhu.

…Speaks on notable achievements of Quasi Fiscal Operations (QFOs) under sanctions

“On our part we will ensure that foreign currency is available to banks for legitimate transactions. If anyone has a foreign invoice for imports or from services rendered by a foreign supplier they can go to the bank and that invoice will be honoured, be it small, medium or large businesses. We are saying we have enough US$ to cover all the ZiG circulating in the country,” he said.

Ngoni Dapira

THE Reserve Bank of Zimbabwe (RBZ) governor Dr John Mushayavanhu says he believes the 50% payment in Zimbabwe Gold (ZiG) of the Quarterly Payment Date (QPD) to the Zimbabwe Revenue Authority (ZIMRA) will compel fuel suppliers to sell some fuel using ZiG, Easterntimeszim has learnt.

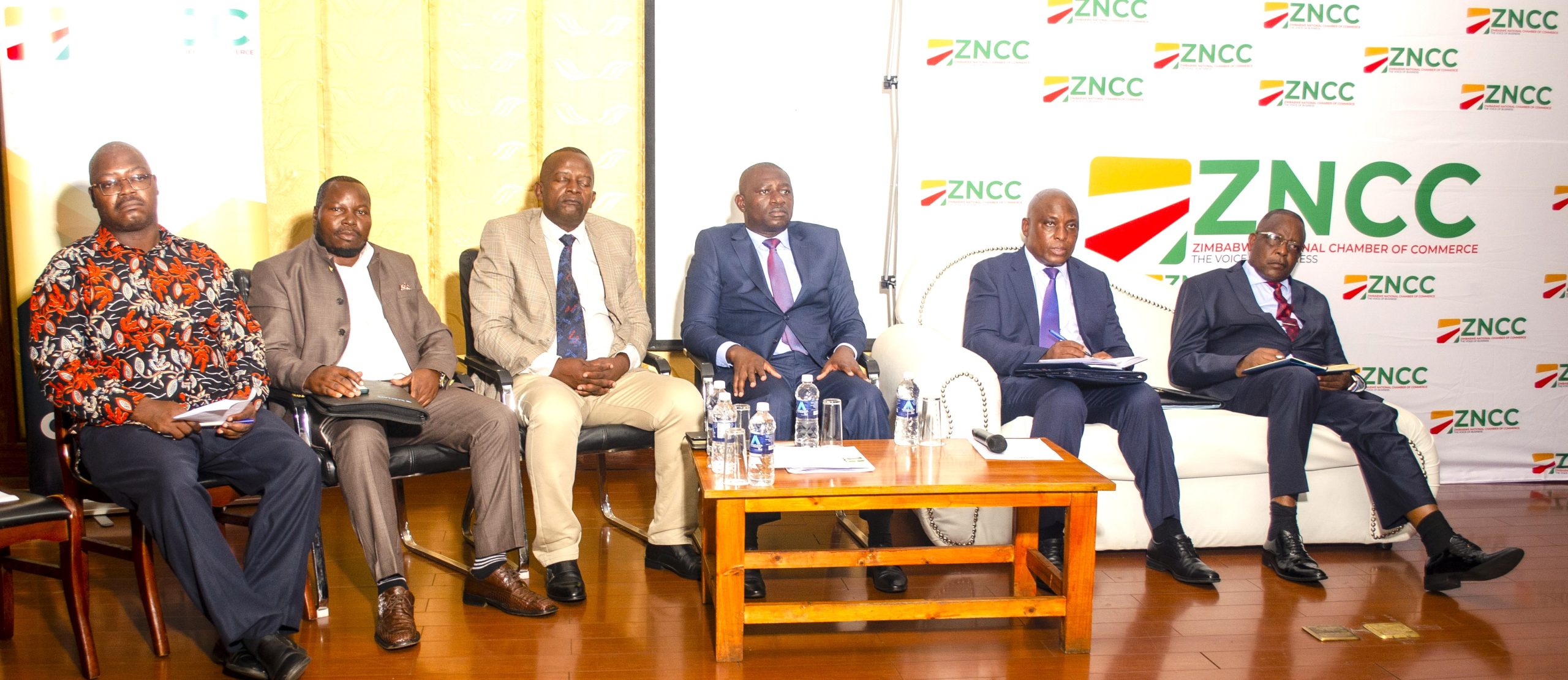

This was said last week Thursday during a Zimbabwe National Chamber of Commerce (ZNCC) Manicaland chapter 2024 Monetary Policy Statement (MPS) review breakfast meeting held in Mutare, officiated by the new RBZ premier.

He said Zimbabwe is currently 80% dollarized and 20% ZiG in its currency usage.

“The fuel issue is under discussion and we want to do it in a manner that will not lead to queues and shortages. We want market forces to play. So, given the fact that companies are going to pay 50% of their QPD in ZiG, this creates demand for ZiG to businesspeople. For fuel dealers, if they do not voluntarily start selling some of their fuel in ZiG, then they will face challenges when they want to pay 50% of their QPD. So, we will not force fuel dealers, but believe market forces will compel them to sell some fuel in ZiG to pay statutory obligations required in ZiG currency,” he said.

Last year, the Finance and Economic Development Minister, Prof Mthuli Ncube, directed taxpayers to settle 50 percent of the foreign currency portion of their corporate tax obligations in local currency for the June 2023 QPD, to promote the use of the Zimbabwe dollar.

Taxpayers who do not have sufficient ZiG to meet their local currency tax obligations will therefore be forced to approach RBZ through their banks to facilitate the conversion of their USD holdings into the required ZiG. The Treasury also warned corporations against engaging in illegal parallel markets, stating that they would face sanctions from the Financial Intelligence Unit.

“So this is where we will drop he bomb on them come June and drop the rate of ZiG for those that will be hunting for ZiG to settle their QPD,” said the RBZ governor.

This will be a positive development for most people, especially civil servants who have part of their salaries paid in ZiG. The RBZ governor also emphasized that he will not print money not backed by reserves citing that government is committed to implementing currency reforms to stabilize the economy and achieve lasting price stability.

Dr Mushayavanhu launched ZiG on 5 April, with notes and coins expected to be in circulation beginning today (Tuesday).

The exchange rate has been stable at ZiG13.6 to US$1 on average, despite unconfirmed parallel market speculations of ZiG20 to US$1 in Harare, whilst some whispered rates of ZiG15 to US$1 in Mutare. Government pronounced stern warnings to black market money changers, with some arrested in Harare. This has seen little to no visibility of money changers on the streets this month, with the Central Bank governor already calling it a sign of victory.

Dr Mushayavanhu said he is trying to ensure that the local currency is accepted not just by the market but also by the government.

“On our part we will ensure that foreign currency is available to banks for legitimate transactions. If anyone has a foreign invoice for imports or from services rendered by a foreign supplier they can go to the bank and that invoice will be honoured, be it small, medium or large businesses. We are saying we have enough US$ to cover all the ZiG circulating in the country,” he said.

He revealed that before, the money supply in the country was growing through quasi fiscal operations (QFOs), which were implemented as a result of sanctions imposed on the country, placing government in a catch-22 situation in which it had limited borrowing powers. According to the International Budget Partnership, quasi-fiscal activities are any activities undertaken by State-owned banks and enterprises, and sometimes by private sector companies at the direction of the government, where the prices charged are less than usual or less than the market rate.

“The only way a Central Bank can generate income is by printing money. So what would happen is that as these loans were being repaid, the Central Bank would buy money from the market and credit the exporters accounts with Zimbabwe dollars, but it was all for the good. All the money that was put on the auction system was coming from the QFOs,” explained the Central Bank governor.

Adding, “There has however been a lot of industrial re-tooling. The Belmont industrial area in Bulawayo in the past 10 years had been converted to churches, but in the past three years all those buildings are becoming factories again, all thanks to the QFOs. So, let’s not just listen to people who say QFOs are bad. It was done at a time when the government could not borrow. But now that sanctions have somewhat been relaxed, the Central Bank has pushed all those liabilities to Treasury, which are now being serviced by Treasury through tax collection. That is why when we say there will be no more money printing, we mean it.”

Dr Mushayavanhu said he is on record to say confidence and trust cannot be legislated or coerced into people, citing that the only being that can be trusted is God. “But what we can do as the Central Bank is to walk the talk. If we say this is what we are going to do and we do it, then over time you (people) will trust us. We have undertaken that there will be no flip-flopping and our Monetary Policy committee meets on a quarterly basis to monitor any red flags,” he said.

Dr Mushayavanhu also echoed the sentiment that anyone who is caught by the police selling foreign currency without a licence must be arrested on the basis that it is an offense according to the law.