Manicaland captains of industry and commerce call for consistent market led intervention polices in 2024 MPS

April 30, 2024

Prominent Mutare lawyer Chibaya’s unprofessional conduct investigation builds up

May 3, 2024Manicaland business implores RBZ to do case by case consideration on outstanding Auction System allotments

CZI past national vice-president Richard Chiwandire.

…IMTT on ZiG and US$ to be reviewed soon by the Finance Minister: Dr Mushayavanhu

Ngoni Dapira

MANICALAND captains of industry and commerce implored the Reserve Bank of Zimbabwe (RBZ) to reconsider its position on outstanding auction allotments announced in the 2024 Monetary Policy Statement (MPS) early this month.

This was said last week Thursday during a Zimbabwe National Chamber of Commerce (ZNCC) Manicaland chapter 2024 Monetary Policy Statement (MPS) review breakfast meeting held in Mutare, officiated by the new Reserve Bank of Zimbabwe (RBZ) governor Dr John Mushayavanhu.

Confederation of Zimbabwe Industry (CZI) past national vice-president Richard Chiwandire said the blanket approach would greatly affect some critical sectors such as agriculture.

“On the Auction System bids, please governor, we cannot wait for two years particularly in the agriculture sector, inputs are critical. I think by now you have already laid out your position, but we are imploring you to look at what is priority and who is key to consider, particularly in agriculture,” said Chiwandire.

Chiwandire was referring to organisations and individuals who bought foreign currency on the Auction System last year, but were not allocated the foreign currency by the time the Zimbabwe Gold (ZiG) pronouncements were made.

The RBZ governor Dr John Mushayavanhu responding to questions.

In the 2024 MPS early this month, Dr Mushayavanhu announced that all outstanding auction allotments will be converted into ZiG and refunded to recipients at the current interbank exchange rate. He said this will allow the new system to start on a clean slate using the interbank foreign exchange system.

The refund will entail conversion of all outstanding auction allotments into a two (2) years ZiG denominated instrument at an interest rate of 7.5 per annum.

Another captain of industry from Willowton Group Zimbabwe revealed that their company is already feeling the pinch of locked up funds in the auction system, what more after two years, as he pleaded with the governor to resolve the matter on a case by case consideration.

“Our day to day running of the business is already being affected, so we hope disbursements will be done gradually to cushion us,” said the gentleman from Willowton Group Zimbabwe, a leading producer of edible oil and soaps.

The high-tech machinery at the Willowton Group Zimbabwe margarine factory.

A US$6 million margarine factory was expected to be complete and opened by December last year as an additional venture to Willowton Group Zimbabwe’s soap and cooking oil manufacturing factory that is already operational at the Mutare plant since 2016.

Sadly, with funds locked up in the auction system coupled with other setbacks of imported equipment that has not yet arrived, commissioning of the project has been delayed.

Responding on the matter, Dr Mushayavanhu said the hands of the Central Bank are tied on the auction arrears matter, but also revealed that it was a few companies disadvantaged, with the list of companies not exceeding more than a page of an A4 exercise book paper.

He said Central Bank should not have held an auction when foreign currency was not there, but however said the total amount in arrears if it is pushed on the market, it will put a lot of pressure on the currency from an exchange rate perspective.

“We are sacrificing a few to stabilise things. That is why we are paying interest,” he said.

Adding, “The arrears matter is a difficult one. We are looking at the the balance sheet of the Central Bank and ask ourselves that how much pressure can we allow on the ZiG. Right now the total amount of ZiG circulating in this economy is ZIG 1 billion and we want to keep it there because it used to be ZW$2.6 trillion when we converted it and that is where it is since 5 April when we introduced ZiG up to today. If we can keep it at that, our exchange rate will stabilize and everything else will be ok. So I hope you will bear with us on that one,” said Dr Mushayavanhu.

The Central Bank governor cleared the air on social media speculations and said ZiG is a homegrown product from Zimbabweans after consulting. He said RBZ consulted everyone including international financial institutions such as the World Bank but the final product of the structured currency ZiG is a Zimbabwean product.

“In Africa there is no other country with a structured currency like we have done. We should be proud that we have taken the lead. Other countries are still using currencies not backed by anything and just print money, but at least our currency is now backed by something tangible,” said the Central Bank premier.

He added that there is no discord between the Central Bank and Ministry of Finance and Economic Development, which is why a lot of adjustments are being made through Statutory Instruments, to resolve grey areas.

In 2022, the Finance Minister, Prof Mthuli Ncube introduced Statutory Instrument 92 of 2022 (SI 92) that introduced a 4% Intermediated Money Transfer Tax (IMTT) on all domestic foreign currency remittances which was later slashed to 2% last year.

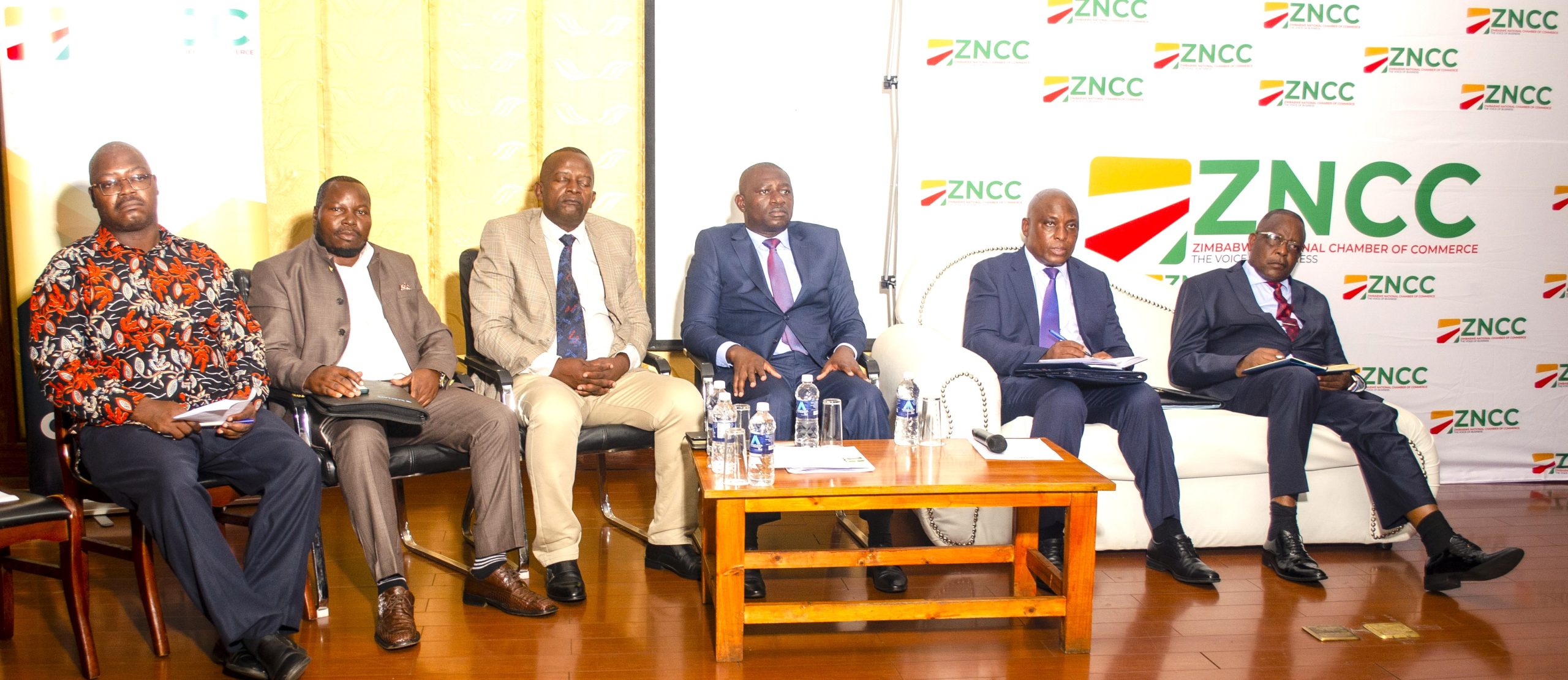

Part of the delegates that attended the ZNCC breakfast meeting in Mutare.

The Manicaland business community implored government to review IMTT to be the same for the growth of ZiG and domestic foreign currency remittances and to promote financial inclusion.

Zimbabweans are already subjected to various tax heads, such as, pay as you earn, the 2% IMMT, 15% value-added tax, among others. In his 2024 National Budget Statement, Minister Prof Ncube kept the IMMT against industry’s request for it to be removed, also introducing the wealth tax and tax on beverages, often referred to as sin tax.

Dr Mushayavanhu said IMMT would be reviewed and made uniform for ZiG and US$ transactions, indicating that the pronouncement will be made soon by the Finance Minister following their recent discusions over the matter.

“Currently as we speak IMTT is at 1% for US$ transactions and 2% on domestic transactions. That was causing a bit of arbitrage or resulting in an implied exchange rate, so the ZiG price will be disadvantaged. What we have done is we have talked to the Finance Minister and he has agreed to standardize the tax, so in the next few days an SI to that effect should be announced. This shows that there is no discord between us with the Finance Ministry, but we are actually frequently engaging to ensure we strengthen our ZiG and stabilize our currency from inflation,” said the RBZ governor.

Chiwandire added that exchange rate stability is possible, but said from an industrial perspective government needs to do more to ensure the competitiveness of local industry.

“We are competing with regional champions in agriculture in terms of economies of scale and if you also look at our cost structure in Zimbabwe in terms of wages, utility costs and so on, we need efficiencies to be competitive and this is where government steps in, and yourself through strict but strategic monetary policies considerate of the operating environment for both large scale and small scale businesses,” said Chiwandire who is the director for Matanuska Holdings (Private) Limited, Zimbabwe’s largest banana producer.

Chiwandire however urged Zimbabweans to have unity of purpose and trust in the structured economy, but also reprimanded government to ensure discipline on implementation which has always come short in the past.

“We can’t afford any slack on the critical path that we are on in the early stages honourable governor. What supports ZiG is the other networks. The blame cannot be placed solely on the governor if it fails, so lets give it all we got to get it right before condemning it,” he said.

Governor Mushayavanhu said to show that they want to promote confidence in banking those with bank balances of US$100 and below or equivalent to ZiG, bank charges have been scrapped. He said this is also meant to promote the saving culture that has been eroded over the years.